BEYOND PREMIUMS: NAVIGATING THE NEW NORMS OF NATURAL CATASTROPHES

Welcome to 2024, where the phrases ‘unprecedented’ and ‘record-breaking’ are not just reserved for Olympic feats or the box office earnings of the latest superhero flick, but are routinely slapped onto descriptions of our global climate situation. I’ve just red Swiss Re’s latest Sigma Study.

The Inconvenient Truth of Rising Risks

From my perspective, nothing less has been dropped than a bombshell. A bombshell that should shake every last cobweb from the dusty corners of corporate risk management strategies. According to this study, we’re not just facing an increase in natural catastrophes; we’re on track to see losses double in the next decade.

And here’s the kicker: these increases are outpacing global GDP growth. For risk managers, this isn’t just bad news; it’s a wake-up call served with a double shot of espresso.

Climbing Costs and Climatic Catastrophes

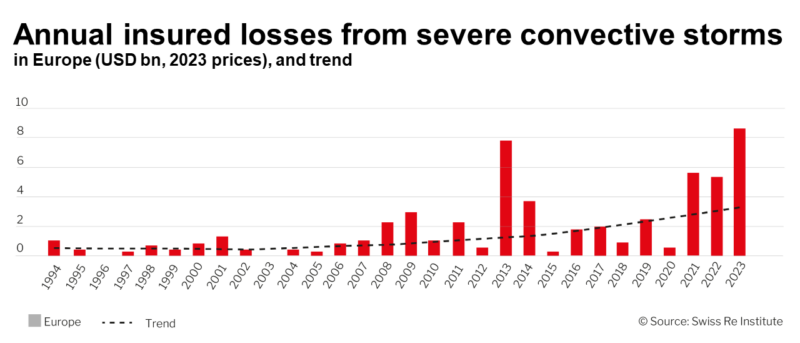

Let’s cut through the usual fluff. The Sigma Study lays out a scenario that could freeze the blood of any hardened financial analyst. Medium-severity events like storms and hail are on the rise, and they’re dragging insurance premiums up with them. Probably into the stratosphere. The economic squeeze is on, and it’s tightening fast—posing a stark challenge to our traditional models of risk management.

The Slow March of Mitigation

If you think the solution is as simple as throwing money at more robust buildings or shifting locations, think again. These mitigation measures are marathon tasks, not sprints. They require a Herculean effort in planning, resources, and time — luxuries we don’t have as the clock ticks down. The bitter truth is, we’re playing catch-up with a climate that’s changing faster than we can reinforce our rooftops.

Restoration: The Resource Drought

Here’s where it gets even messier for businesses: the demand for restoration services in the aftermath of these events is starting to exceed supply. The market is a jungle, and in the wake of a disaster, it’s survival of the fittest — or, in this case, the quickest to call. Companies without a pre-dialed restoration company might find themselves at the back of a very long line, facing extended downtimes and financial haemorrhage. Companies might have enough financial ressources for all the restoration meassures – but they´ll still won´t be able to skip the line.

Strategic Partnerships: The Smart Move

In this high-stakes environment, the clever money is on forming strategic partnerships with restoration companies. Securing a spot on their priority list means when disaster strikes, you’re first in line for recovery services. It’s about ensuring controlled, efficient recovery processes that can be the difference between a swift comeback and a costly sabbatical.

Such partnerships aren’t just about bolstering resilience; they’re about ensuring you have the upper hand in disaster scenarios. This proactive approach supports continuity and stability—crucial components in maintaining trust and operational viability post-catastrophe.

Call to Arms

Risk managers, the writing is on the wall. In this age of climatic unpredictability, you need to pivot from traditional, reactive measures to proactive, strategic planning. This is not just about buying insurance; it’s about buying time. Establishing partnerships with restoration experts isn’t just clever; it’s critical. It’s not about avoiding the unavoidable; it’s about preparing for the inevitable.

In conclusion, the latest Sigma Study isn’t just another industry report; it’s a manifesto for change in how we approach the ever-growing threat of natural disasters. Ignoring it isn’t just irresponsible; it’s business malpractice. As we move forward, let’s not just brace for impact—let’s rebuild the way we think about risk. After all, in the business world, those who adapt not only survive; they thrive.

How to prepare your business for natural catastrophes?

Good risk managment can limit the damage in a natural catastrophe

Europe has again been hit by extreme weather this summer, resulting in floods in northern Italy. In 2021 it was the German region of Ahrtal valley and in 2022, large parts of the UK were submerged. In May, the wealthy region of Emilia Romagna was hit with six months of rainfall in just 36 hours. Read full article…